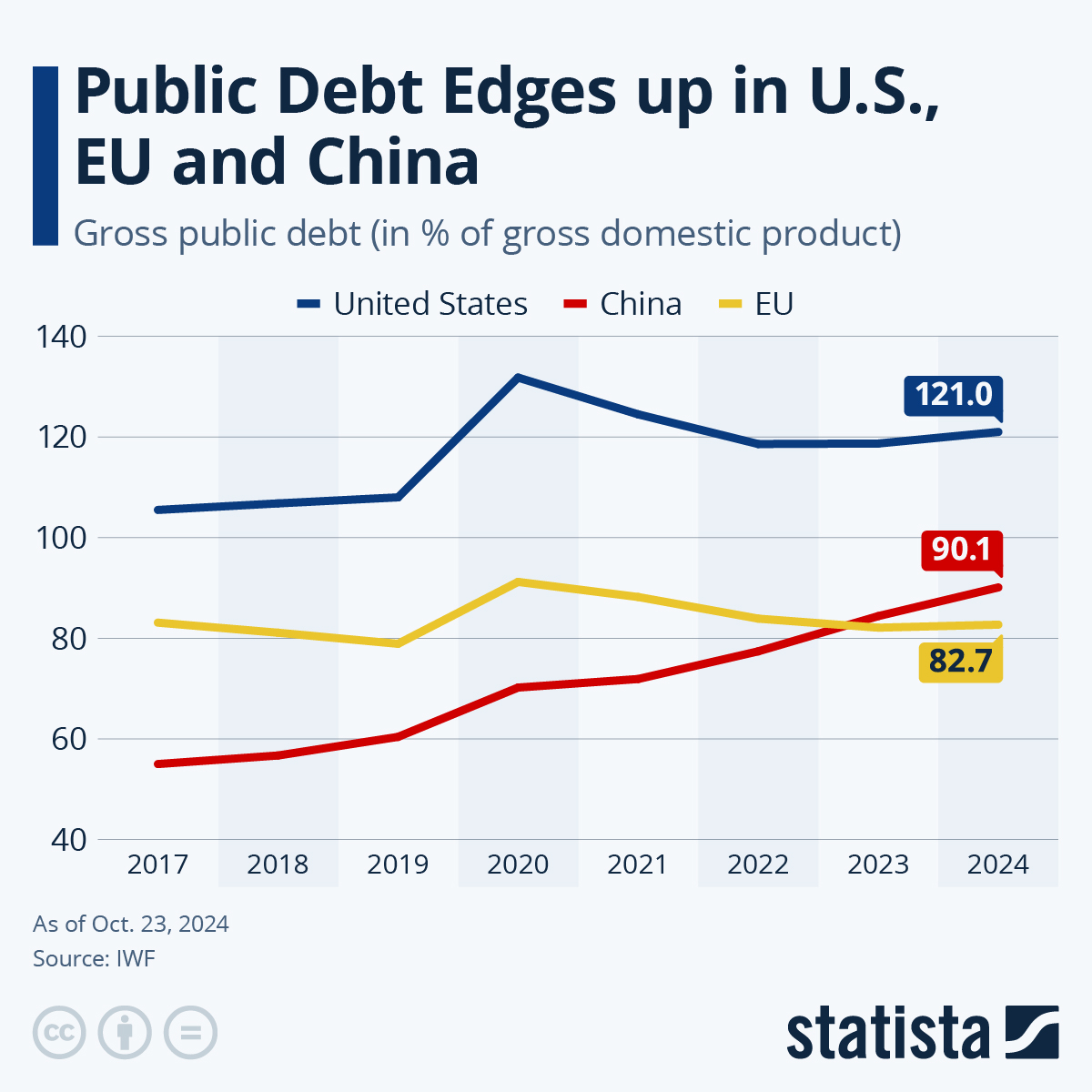

Here are detailed numbers by the International Monetary Fund (IMF)

Public debt levels have ticked up again in the United States, the EU and China in 2024, according to estimates by the International Monetary Fund (IMF). This year, U.S. government debt is expected to reach 121 percent of GDP, compared to 90.1 percent of GDP in China and 82.7 percent of GDP in the EU.

Looking back over recent years, public debt rose to around 132 percent of GDP in the first year of the coronavirus pandemic in the U.S., marking an increase of almost 24 percentage points from 2019. The increase in debt in the European Union and China was significantly lower during this period.

However, the debt ratio in the U.S. also fell again relatively sharply in 2021, down 7.3 percentage points compared to 2020. By contrast, the Chinese government’s debt has continued to rise steadily between 2020 and 2024. While China has fueled growth with significant, credit-financed investments, this economic policy is also reflected in the country’s rising national deficit.

National debt is expressed in absolute terms in the national currency. The debt ratio/government debt ratio is the ratio of government debt to gross domestic product (GDP). If government expenditure exceeds government revenue, this is referred to as a budget deficit (as opposed to budget surplus).

Yeah, I didn’t want to change the original title, but it is right. In the EU the public debt remains quite stable.